A digital marketing strategy is the path to profitability. Optimum7 can help you set the right goals, offer and implement creative and technical strategies, and use data and analytics to review and improve your business’s performance.

ACH E-Check Payment Integration for BigCommerce and Shopify

Enable secure, low-cost ACH eCheck payments on your online store—ideal for high-value, high-volume, or recurring transactions processed electronically through a reliable payment gateway.

Today’s online businesses need payment solutions that balance security, speed, and cost-efficiency. If your eCommerce store handles B2B transactions, large orders, or subscription services, ACH eCheck payments are a smart alternative to costly credit card processing.

Our team custom builds ACH eCheck integrations for Shopify, BigCommerce, Magento, Volusion, and custom platforms—tailored to your business model, risk level, and payment workflow.

Broad Compatibility

Efficiency in Transaction Processing

Enhanced Payment Security

Oil & Gas

Streamlines payment processes for large-scale transactions, enhancing efficiency in a sector where payment accuracy is critical.

Aviation

Facilitates quick and secure transactions, beneficial for aviation companies dealing with high-volume ticketing and services.

Manufacturers

Improves transaction speed and accuracy, essential for manufacturers managing numerous transactions for raw materials and products.

Construction

Offers a reliable payment solution for contractors and suppliers, ensuring timely and accurate payments in project management.

Chemical Manufacturing

Ensures secure and efficient transactions, vital in an industry with high-value products and services.

Tool & Equipment Manufacturing

Benefits from fast and secure payment processing, essential for quick customer service and inventory management.

Power & Energy Suppliers

Enhances transaction efficiency, vital for the timely procurement of energy supplies and services.

Automotive Manufacturing

Supports streamlined payment processes, crucial for managing the complex supply chains and retail operations in this sector.

Electronics Manufacturing

Offers a secure and efficient payment gateway, important for an industry dealing with high volumes of online sales and global transactions.

Our team can give you a FREE custom quote for getting this functionality implemented on your website today.

What Is an ACH eCheck?

An ACH eCheck is a digital version of a paper check, processed through the Automated Clearing House (ACH) network. Instead of mailing checks or relying on wire transfers or traditional payment methods, customers can pay online using their bank account number and routing number, just like they would with a physical check.How It Works:

- Authorization: Customer agrees to pay via eCheck

- Bank Verification: Instant or delayed (via micro-deposits)

- Payment Initiation: Funds are requested from customer’s bank

- Clearing & Settlement: Merchant receives payment in 1–3 business days

✅ Secure

✅ Reliable

✅ NACHA-compliant

✅ Ideal for B2B and recurring billing

To fully understand how ACH eChecks benefit your store, let’s walk through the exact payment process from authorization to settlement.Understanding ACH eCheck Processing

An ACH eCheck is a digital version of a traditional paper check, processed through the Automated Clearing House (ACH) network. This electronic fund transfer method allows for direct payments from a payer’s bank account to a merchant, making it a more streamlined alternative to credit card payments or debit card transactions.How ACH eCheck Payments Work:

- Authorization: The customer authorizes the payment, either online or via a signed agreement.

- Payment Initiation: The merchant submits the payment details to their payment processor.

- Processing: The payment processor forwards the transaction through the ACH network.

- Settlement: Funds are debited from the customer's account and credited to the merchant's account, typically within 1–3 business days.

Advantages of ACH eChecks over Traditional Checks

Transitioning from paper checks to ACH eChecks offers several advantages:- Speed: ACH eChecks clear faster than traditional checks, often within 1–3 business days.

- Cost-Effectiveness: Lower processing fees compared to paper checks and credit card transactions.

- Security: Enhanced security features reduce the risk of fraud associated with paper checks.

- Convenience: Eliminates the need for physical handling and manual processing of checks.

eCheck vs ACH vs Credit Card vs Wire Transfer

ACH and eChecks are often confused, so here’s the breakdown:| Payment Type | What It Is | Use Case |

| eCheck (ACH debit) | A digital check processed via ACH | Customer-initiated B2B/B2C |

| ACH Credit | Direct deposit or vendor payout | Payroll, refunds |

| Credit Card | Instant card-based payment with higher fees | B2C retail |

| Wire Transfer | Immediate, high-cost bank-to-bank transfer | International or same-day B2B |

Why Add ACH eCheck Payments to Your eCommerce Store?

✅ Lower Fees Than Credit Cards

Credit card fees average 2.5–3.5% per transaction. ACH eCheck fees are $0.20 to $1.50, flat-rate—making it ideal for:- High-ticket orders

- Subscription billing

- Wholesale transactions

✅ Enhanced Customer Trust

Many B2B buyers prefer using bank transfers over credit cards. eChecks are secure, PCI-compliant, and don’t require storing card info.✅ Faster Payments & Fulfillment

Funds clear in 1–3 days, and our solution notifies your team automatically. Say goodbye to manual check processing.✅ Streamlined Operations

- Automated reconciliation with accounting tools

- Real-time status tracking

- Custom dashboards and reporting

Security, Compliance & NACHA Standards

All ACH eCheck integrations meet strict NACHA (National Automated Clearing House Association) standards. That means:✅ Encrypted bank account storage

✅ Secure tokenization (no raw account data saved)

✅ TLS/SSL site encryption

✅ User activity audit trails

✅ Multi-factor admin authentication

We also help you implement proper authorization workflows, including click-to-sign checkboxes, emailed authorizations, or signed web forms—protecting your business from disputes or chargebacks. Our integrations also include robust security measures to reduce fraud, protect sensitive bank account numbers, and handle scenarios like insufficient funds or failed transactions safely.How It Works for Your eCommerce Store

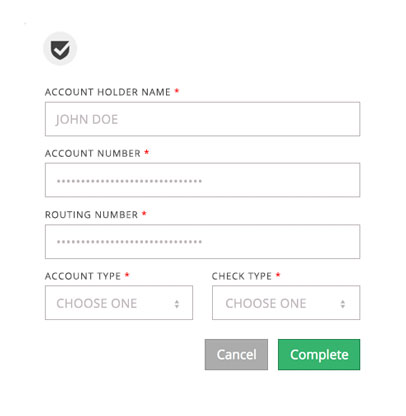

Here’s how a typical eCheck flow looks inside your online checkout:- Customer chooses "Pay with Bank Account"

- They enter routing + account number

- System verifies bank info (via instant verification or micro-deposits)

- Customer authorizes payment

- Payment is submitted to ACH network

- Funds are deposited in your account within 1–3 business days

- Order status is automatically updated in your admin panel

ACH Debit vs. ACH Credit

Understanding the distinction between ACH debit and ACH credit transactions is crucial:- ACH Debit: The merchant initiates the transaction to "pull" funds from the customer's account.

- ACH Credit: The customer initiates the transaction to "push" funds to the merchant's account.

eChecks vs. ACH Payments: Clarifying the Terms

While often used interchangeably, eChecks and ACH payments have distinct characteristics:- eCheck: A digital version of a paper check, processed through the ACH network, typically used for one-time payments.

- ACH Payment: A broader term encompassing various types of electronic bank-to-bank payments, including direct deposits and recurring transactions.

Supported Platforms & Integration Methods

Whether you're on a modern SaaS platform or legacy eCommerce system, we’ve got you covered:Shopify ACH eCheck Integration

- Private app integration via secure iframe/gateway

- Customer bank verification

- Support for one-time and subscription billing

- Optional fraud flags and order rules

BigCommerce ACH Payment Integration

- Checkout customization using Storefront & Checkout APIs

- Gateway integration (e.g., Authorize.Net, Dwolla

- ACH logic by customer group, cart value, or product type

- Dashboard with ACH-specific filters and reports

Magento (Adobe Commerce) ACH Integration

- Modular extension with admin visibility

- ERP & accounting sync

- Customer groups for ACH eligibility

- Custom retry + approval workflows

Volusion ACH Payment Setup

- Embedded secure checkout form

- Bank data tokenization

- Email alert system for ACH events

- Gateway fallback logic

Industries That Benefit the Most

Our ACH integration is ideal for industries with large orders, recurring clients, or subscription services:| Industry | Why ACH Matters |

| Oil & Gas | Simplifies recurring large invoice payments |

| Aviation | Speeds up ticketing & service payments |

| Construction | Ideal for contractor invoicing + project payments |

| Manufacturing & Tools | Perfect for bulk order processing and supplier sync |

| Chemical Distribution | Secure high-value transactions with audit control |

| Automotive B2B Sales | Handles dealership and vendor orders |

| Electronics eCommerce | Global checkout support + bank trust |

| Power & Energy | Recurring service payments and supply ordering |

Features Included in Our ACH eCheck Integration

| Feature | Description |

| ✅ Instant Bank Verification | Reduces fraud by confirming account ownership |

| ✅ Recurring Payment Support | Supports monthly, quarterly, or annual billing cycles |

| ✅ Automated Order Updates | Order status reflects payment confirmation in real-time |

| ✅ Retry + Failover Logic | Automatically retries or offers card fallback if eCheck fails |

| ✅ Role-Based Admin Access | Control who can issue, refund, or override eCheck transactions |

| ✅ Dashboard & Reports | View transaction history, status, revenue impact, and reconciliation data |

Optional Enhancements

We offer advanced customizations tailored to your use case:- ACH + Invoice Payment Logic (for Net Terms)

- ACH for Membership Gated Content or SaaS

- ACH Token Vault for Returning Customers

- ERP Integration (NetSuite, SAP, QuickBooks)

- ACH + Buy Now, Pay Later Compatibility

Visual Suggestions for Page Layout

Include the following UX improvements:- Platform compatibility carousel (Shopify, Magento, etc.)

- 1-min demo video of ACH checkout flow

- Feature cards with icons for each core benefit

- Industry use case grid with icons

- Comparison table: ACH vs Credit Cards vs Wire Transfers

FAQs About ACH E-Check Payment Integration

What’s the difference between an ACH and an eCheck?

An eCheck is a type of ACH payment that mimics a paper check online. ACH is the broader network used to process electronic bank transfers.Are ACH payments secure?

Yes. All transactions are encrypted and processed through regulated financial gateways that meet NACHA and PCI compliance.How long do eCheck payments take to process?

Typically 1–3 business days, depending on the bank and verification method used.Can customers save their bank info for future use?

Yes, we offer tokenized bank info storage—fully PCI-compliant—for repeat customers.Do you support subscription billing with ACH?

Absolutely. Perfect for memberships, SaaS, and any recurring payments.Can I set ACH as the default payment for certain customer groups?

Yes. You can configure payment methods based on login status, group, or order value.Which businesses should accept eCheck payments?

While eChecks are beneficial for many merchants, they’re particularly valuable for businesses that process high-value, recurring, or invoice-based payments. eCheck processing is ideal for:- eCommerce merchants (especially those with subscriptions or payment plans)

- Membership-based businesses like gyms, clubs, and fitness studios

- Rental and financing businesses, such as apartments, car dealerships, or appliance rentals

- B2B suppliers and wholesale merchants who receive large payments from buyers

- Nonprofit organizations that process recurring donations

- Educational institutions accepting tuition or fee-based payments

Can eChecks increase revenue for merchants?

Yes. Accepting eChecks can directly contribute to increased revenue by:- Lowering payment processing fees compared to credit cards or wire transfers

- Reducing cart abandonment for customers who prefer bank transfers

- Enabling high-ticket purchases that may be limited by credit card caps

- Facilitating recurring revenue through subscription or membership billing

- Improving cash flow with faster processing than mailed checks or invoicing

Can I use this system to accept eChecks online and still accept credit cards?

Yes. Our solution allows you to accept eChecks online alongside credit card payments and other payment methods based on your business rules and customer groups.Ready to Accept ACH eChecks on Your Store?

Whether you're running a B2B supply company, industrial storefront, or subscription-based eCommerce brand—ACH eCheck payment integration gives you the edge:

✅ Save on credit card fees

✅ Speed up processing

✅ Improve security and customer confidence

✅ Automate payment workflows