Every firm has encountered additional constraints in the last year, from higher demand to restricted margins, with agencies bearing the worst of it.

Clients demand more transparent and cost-effective services from the agencies they deal with on a daily basis, and it’s up to the finance team at the agency to guarantee that the company fulfills these standards.

Many organizations are turning to cutting-edge technologies to help them manage their finances more efficiently and keep up with rapid initiatives.

Agency Financial Management

However, it’s more than simply finding the best technology for your team. You must also establish sound financial procedures to be successful.

One of the most important aspects of effective financial management is creating accurate forecasts.

Financial Forecasting

By predicting how much revenue your agency will generate in the future, you can better manage expenses and allocate resources where they’re needed most.

Forecasting can be difficult, especially for agencies that work with a variety of clients and projects, but there are a number of software tools that can help. Specialized project management software and CRM platforms can empower you to make more accurate predictions.

Financial Tracking

Another important part of financial management is tracking invoices and payments. This includes ensuring that bills are paid on time and that you’re keeping track of who owes your agency money.

Automated billing and payment systems can make this process much easier, freeing up your team to focus on more important tasks.

Of course, financial management is about more than just numbers. It’s also important to have a good understanding of your agency’s overall financial health so you can identify any potential problems early on. Regularly reading account statements and employee performance can help you stay current on your finances.

Make a Budget and Stick to It

Creating and adhering to a budget is one of the most important aspects of financial management. This means tracking both income and expenses on a regular basis and being realistic about what can be afforded.

It can be helpful to break down the budget into monthly or even weekly increments, in order to stay on track.

Manage Debt Wisely

If left unattended, credit card debt, or any other high-interest debt, may swiftly get out of hand. One way to avoid this is by creating a plan for how much money can be put towards debt repayment each month, and then sticking to it.

It’s also important to keep an eye on your interest rates, especially if you have a variable rate. Keeping track of them via month-end reporting, for example, is critical since it gives the rest of the agency a clear view of the company’s current financial status. As a result, everyone is better equipped to generate more informed judgments based on

Financial management is an essential part of any successful agency, and by following these tips, you can be sure that your team is well-equipped to handle whatever challenges come their way.

Month-End Reporting

Is your agency in the habit of losing money on work it hasn’t even started yet? Are you frequently missing deadlines, which means your clients frequently don’t pay for their ads?

Financial management is paramount in terms of running a successful business. Make no mistake: an underperforming agency can’t survive long-term with these kinds of problems.

Financial reports at the end of every month are crucial, as they give everyone else an idea about how well your company is doing financially.

Month-end reporting is unquestionably one of the most critical aspects of any organization.

Financial reports let everybody know where the company stands now so that they can more informed and insightful decisions.

It doesn’t have to be a lengthy process.

Instead, it can be condensed into as little as four days, with clear processes on each day.

1st day – The finance team accumulates any outstanding costs while employees submit their timesheets. Meanwhile, project managers should be evaluating the progress of each individual project and making adjustments, as needed, to make sure everything is going according to plan.

2nd day – Managers must now present all of their work after beginning to measure project progress on the first day.

3rd day – The finance team is responsible for making sure that the profit and loss have been calculated correctly. Additionally, they should check for any tax costs, if they apply, in order to factor this information into their final balance sheet.

4th day – The finance team needs to create a clear, accurate, and comprehensible report that will be shared with the entire agency. This way, every member of staff has up-to-date information on where they stand towards reaching annual targets by month’s end.

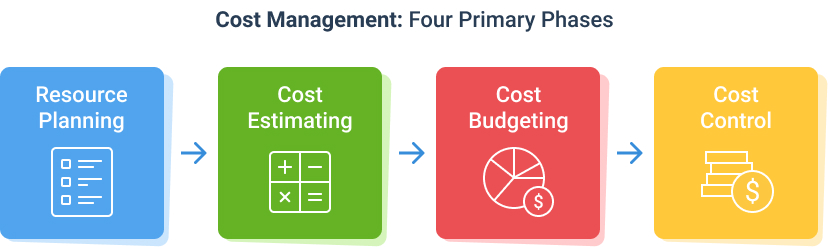

Cost Management

As a finance leader, you know the importance of proactive cost management. By taking steps to manage costs effectively, you can secure your agency’s bottom line and create a true picture of the company’s financial profile.

Many fixed expenditures, such as office renting, internet, IT services, and payroll, are incurred each month. By better understanding your financial performance, you can make smarter decisions about where to focus your financial resources.

Financial Intelligence is Critical

Financial intelligence is crucial in this environment for organizations aiming to enhance organizational efficiency and better financial performance.

While it’s easy to understand revenue and expenses as a percentage of total income, understanding how these numbers break down on a monthly basis will give you a deeper perspective into the challenges affecting your business financials. Financial analytics software can provide access to financial data through interactive reports and visualizations that assist build a complete financial picture.

This brings us closer to home — the heart of every agency: its people! It’s far too simple to fall victim to misconceptions or misunderstandings.

_________________________________________________________________________________________________________________________

Capital Management

Capital management has always been at the heart of what agency finance teams do. While other team members are focused on ensuring clients are getting good value for their investment, it’s the finance team’s responsibility to ensure the agency is also getting the best return on the time it spends with clients as well.

Good capital management is about more than just managing revenue coming in. It’s also important to keep project managers accountable for their own KPIs and ensure other team members within the agency provide accurate information. This is done through regular timesheets or expense reports so that you can make sound decisions with confidence.

There are a few key ways that finance teams can manage capital effectively. One is through careful financial planning and budgeting.

Careful Financial Planning and Budgeting

This includes forecasting how much revenue the agency can expect to bring in over a given period, as well as estimating how much money will be needed to cover expenses.

Having a clear understanding of these figures enables the finance team to set realistic financial goals and make sure they have enough cash flow to cover day-to-day costs.

Another key way to manage capital is by being mindful of the agency’s financial liabilities. This includes things like outstanding invoices, loans, and credit card balances.

Finance teams need to be proactive about ensuring these liabilities don’t become a burden on the business. This might mean negotiating more favorable terms.

Employee Productivity & Efficiency Calculations

This represents one of the biggest costs for many businesses.

Salaries and wages comprise the major line-item expense for most retail and small-scale manufacturing companies. The only way to definitively calculate accurate labor expenses is by creating a cost accounting system to track all expenditures.

However, rather than build such a system from scratch, agency managers can use Excel spreadsheets or business management apps. These simplify and automate this process to determine how efficiently employee time is spent on company tasks.

Measuring Productivity of Employees

One of the most important aspects of any organization is its productivity. Measuring employee productivity is essential for agencies in order to make sure that their resources are being used in the most efficient way possible.

In this section, we will explore some methods for measuring employee productivity and offer tips for increasing it. There are a number of ways to measure employee productivity.

The most common method is to track the number of units an employee produces in a given time period. This can be done by counting the number of widgets an employee makes in an hour, the number of sales calls made in a day, or the number of passengers served at an airport.

Measuring Employee Efficiency

There are a variety of ways to measure employee efficiency. One popular way is through the use of the unit of service (UOS) measurements. UOS analysis is usually job-specific and is most relevant to employees who have jobs that are repetitive.

Some jobs, particularly professional jobs that have variable output, defy reasonable UOS measurements. In these cases, managers may need to rely on other methods of measuring productivity and efficiency, such as time-tracking or goal setting.

Now that you understand how to measure employee efficiency, let’s take a look at some of the ways that agencies can improve it.

Improving Employee Efficiency

One way to improve employee efficiency is to ensure that employees have the appropriate tools and resources to do their jobs. This may include providing computers, software, or other equipment, as well as adequate office space and support staff.

Another way to improve employee efficiency is to create a work environment that is conducive to productivity. This may include setting clear goals and expectations, providing adequate training, and establishing a positive work culture.

Finally, agencies can also improve employee efficiency by offering appropriate incentives and rewards. This may include monetary bonuses, vacation days, or other benefits.

Conclusion

Financial Management is a lifeline for agencies. If you cant manage your money, you will take one step forward and two steps back, and wonder why you are not making any profit. It is that simple.

But it is not that hard to successfully manage your agency’s finance. Just follow these steps carefully and make sure to contact us for further business consultation.